A good understanding of the basic tenets of technical analysis can vastly improve one's trading skills.

When using technical analysis, price is the primary tool. Simply put, "everything is already in the rate." However, technical analysis involves a bit more than simply staring at price charts hoping to find a "yellow brick road" to a bonanza payday. Along with various methods of plotting price action on charts by using bars, candlesticks, and Xs and Os on point and figure charts, market technicians also employ many technical studies that help them to delve deeper into the data. By using these studies in conjunction with their price charts, traders are able to build much stronger cases to buy, sell or remain on the sidelines than they could by simply looking at price charts alone.

Here are descriptions of some of the more widely used and time-tested studies that technicians keep in their toolboxes:

Moving Averages, Stochastics, RSI, Bollinger Bands, MACD

Moving Averages One of the most basic and widely used indicators in a technical analyst's tool box, moving averages help traders verify existing trends, identify emerging trends, and view overextended trends about to reverse. Moving averages are lines overlaid on a chart indicating long term price trends with short term fluctuations smoothed out.

One of the most basic and widely used indicators in a technical analyst's tool box, moving averages help traders verify existing trends, identify emerging trends, and view overextended trends about to reverse. Moving averages are lines overlaid on a chart indicating long term price trends with short term fluctuations smoothed out.There are three basic types of moving averages:

- Simple

- Weighted

- Exponential

A simple moving average gives equal weight to each price point over the specified period. The user defines whether the high, low, or close is used and these price points are added together and averaged. This average price point is then added to the existing string and a line is formed. With the addition of each new price point the sample set drops off the oldest point. The simple moving average is probably the most widely used moving average.

A weighted moving average gives more emphasis to the latest data. A weighted moving average multiplies each data point by a weighting factor which differs from day to day. These figures are added and divided by the sum of the weighting factors. A weighted moving average allows the user to successfully smooth out a curve while having the average more responsive to current price changes.

An exponential moving average is another way of "weighting" the more recent data. An exponential moving average multiplies a percentage of the most recent price by the previous period's average price. Defining the optimum moving average for a particular currency pair involves "curve fitting". Curve fitting is the process of selecting the right number of periods with the correct type of moving average to produce the results the user is trying to achieve. By trial and error, technicians work with the time periods to fit the price data.

Because the moving average is constantly changing based on the latest market data, many traders will use different "specified" time frames before they come up with a series of moving averages that are optimal for a particular currency.

For example, a trader might create a 5-day, a 15-day and a 30-day moving average for a currency and then plot them on his or her price chart. He might start out using simple moving averages and end up using weighted moving averages. In creating these moving averages, traders need to decide on the exact price data that will be used in this study; meaning closing prices vs. opening prices vs. high/low/close etc. After doing so, a series of lines are created that reflect the 5-day, 15-day and 30-day moving average of a currency.

Once the data is layered over a price chart, traders can determine how well these chosen periods keep track of the trend being followed. If, for example, a market is trending higher, you'd expect the 30-day moving average to be a very accurate trend line, providing a line of support for prices on their way higher. If prices seem too close under this 30-day moving average on several occasions without resulting in a halt in the up trend, a trader will simply adjust the time period to say a 45-day or 60-day moving average in order to optimize the average. In this way, the moving average will act as a trend line.

After determining the optimum moving average for a currency, this average price line can be used as a line of support in maintaining a long position or resistance in maintaining a short position. Breaches of this line can also be used as a signal that a currency is in the process of reversing course, in which case a trader will want to pare back an existing position or come up with entry levels for a new position. For example, if you determine that a 30-day moving average has shown itself to be a good support line for USD-JPY in an upward trending market, then market closes under this 30-day moving average line could be a signal that this trend could be running out of steam. However, it is important to wait for confirmation of these signals. One way to do this is to wait for another close below the level. On the second close under the average, you should begin to pare down your position. Another confirmation involves using other, shorter term moving averages.

While a longer term moving average can help to define and support a particular trend, shorter term moving averages can provide lead signals that a trend is ending before prices dip below your longer term moving average line. For this reason, most traders will plot several moving averages on the same chart. In a market that is trending higher, a shorter term moving average might signal a market reversal by turning down and crossing over the longer term moving average. For example, if you are using a 15-day and a 45-day moving average in a market that is in an up trend, and the 15-day moving average turns down and crosses over the 45-day moving average, this could be an early signal that the up trend is ending and it is probably time to begin to pare down your position.

Stochastics

Stochastic studies, or oscillators, are another useful tool for monitoring the expected sustainability of a trend. They provide a trader with information about the closing price in the current trading period relative to the prior performance of the instrument being analyzed.

Stochastics are measured and represented by two different lines, %K and %D and are plotted on a scale ranging from 0 to 100. Indications above 80 represent strong upward movement while level indications below 20 represent strong downward movements. The mathematics behind the studies are not as important as knowing what the stochastics are telling you. The %K line is the faster, more sensitive indicator while the %D line takes more time to turn. When the %K line crosses over the %D line, this could be an indication that a market is about to reverse course. Stochastic studies are not useful in choppy, sideways markets. At times when prices are fluctuating in a narrow range, the %K and %D lines might be crossing many different times and will be telling you nothing more than the market is moving sideways.

Stochastics are most useful in measuring the strength of a trend and as augurs of a coming reversal in prices. When prices are making new highs or lows and your stochastics are doing the same, you can be reasonably certain that the trend will continue. On the other hand, many traders finds that the best trading opportunity comes when their stochastic indicator is flattening out or moving in the opposite direction of prices. When these divergences occur, it's time to book profits and/or to establish a position in the opposite direction of the prior trend.

As should always be the case when using any technical tool, do not act on the first signal you see. Wait at least one or two trading sessions for confirmation of what the study is indicating before you commit to a position.

Relative Strength Index (RSI)

RSI measures the momentum of price movements. It is also plotted on a scale ranging from 0 to 100. Traders will tend to look at RSI readings over 80 as an indicator of a market that is overbought or susceptible to a downturn, and readings under 20 as a market that is oversold or ready to turn higher.

This logic therefore implies that prices cannot rise or fall forever and that by using an RSI study, one can determine with a reasonable degree of certainty when a reversal will come about. However, be very wary of trading on RSI studies alone. In many instances, an RSI can remain at very lofty or sunken levels for quite a while without prices reversing course. At these times, the RSI is simply telling you that a market is quite strong or quite weak and shows no signs of changing course.

RSI studies can be adjusted to whatever time sensitivity a trader feels necessary for his or her particular style. For instance, a 5-day RSI will be very sensitive and will tend to give many more signals, not all of them sustainable, than say a 21-day RSI, which will tend to be less choppy. As with other studies, try a variety of time periods for the currency that you are trading based on your trading style. Longer term, position type traders, will tend to find that shorter time frames used for an RSI (or any other study for that matter) will give too many signals and will result in over-trading. On the other hand, shorter time frames will probably be ideal for day-traders trying to capture many shorter-term price fluctuations.

As with stochastics, look for divergences between prices and the RSI. If your RSI turns up in a slumping market or turns down during a bull run, this could be a good indication that a reversal is just around the corner. Wait for confirmation before you act on divergent indications from your RSI studies.

Bollinger Bands

Bollinger Bands are volatility curves used to identify extreme highs or lows in relation to price. Bollinger Bands establish trading parameters, or bands, based on the moving average of a particular instrument and a set number of standard deviations around this moving average.

For example, a trader might decide to use a 10-day moving average and 2 standard deviations to establish Bollinger Bands for a given currency. After doing so, a chart will appear with price bars capped by an upper boundary line based on price levels 2 standard deviations higher than the 10-day moving average and supported by a lower boundary line based on 2 standard deviations lower than the 10-day moving average. In the middle of these two boundary lines will be another line running somewhat close to the middle area depicting in this case, the 10-day moving average. Both the moving average and the number of standard deviations can be altered to best suit a particular currency.

Jon Bollinger, creator of Bollinger Bands recommends using a simple 20-day moving average and 2 standard deviations. Because standard deviation is a measure of volatility, Bollinger Bands are dynamic indicators that adjust themselves (widen and contract) based on the current levels of volatility in the market being studied. When prices hit the upper or lower boundaries of a given set of Bollinger Bands, this is not necessarily an indication of an imminent reversal in a trend. It simply means that prices have moved to the upper limits of the established parameters. Therefore, traders should use another study in conjunction with Bollinger Bands to help them determine the strength of a trend.

MACD - Moving Average Convergence Divergence

MACD is a more detailed method of using moving averages to find trading signals from price charts. Developed by Gerald Appel, the MACD plots the difference between a 26-day exponential moving average and a 12-day exponential moving average. A 9-day moving average is generally used as a trigger line, meaning when the MACD crosses below this trigger it is a bearish signal and when it crosses above it, it's a bullish signal.

As with other studies, traders will look to MACD studies to provide early signals or divergences between market prices and a technical indicator. If the MACD turns positive and makes higher lows while prices are still tanking, this could be a strong buy signal. Conversely, if the MACD makes lower highs while prices are making new highs, this could be a strong bearish divergence and a sell signal.

Fibonacci Retracements

Fibonacci retracement levels are a sequence of numbers discovered by the noted mathematician Leonardo da Pisa during the twelfth century. These numbers describe cycles found throughout nature and when applied to technical analysis can be used to find pullbacks in the currency market.

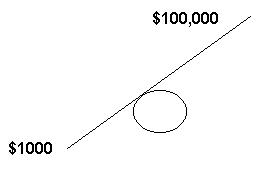

Fibonacci retracement involves anticipating changes in trends as prices near the lines created by the Fibonacci studies. After a significant price move (either up or down), prices will often retrace a significant portion (if not all) of the original move. As prices retrace, support and resistance levels often occur at or near the Fibonacci Retracement levels.

In the currency markets, the commonly used sequence of ratios is 23.6 %, 38.2%, 50% and 61.8%. Fibonacci retracement levels can easily be displayed by connecting a trend line from a perceived high point to a perceived low point. By taking the difference between the high and low, the user can apply the % ratios to achieve the desired pullbacks.

One final word of advice: Don't get too caught up in the mathematics involved in putting together each study. It is much more important to understand how and why studies can and should be manipulated based on the time periods and sensitivities that you determine are ideal for the currency you are trading. These ideal levels can only be determined after applying several different parameters to each study until the charts and studies begin to reveal the "details behind the details."